Money has become an integral part of our lives. We dedicate maximum amount of our time towards doing things that’ll help us generate money. While do this however we fail to check on the leakage; ie: the outflow of money. Failure to maintain a balance between the two opens the doors to debt.

(P.C: Pexels.com)

(P.C: Pexels.com)

Debt is a state of mind first. The first rule to overcome a debt trap is to find out if you’re actually in a debt or if you’re moving towards a debt-like situation. There are people who think that they are in debt but are not. There are also people who think that they are doing well financially well just because they’re earning a good sum but who fail to realise that they’re actually in a deep debt.

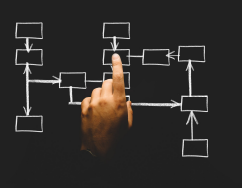

To analyse and find out if you’re in a debt or not is crucial for framing the action plan towards a financial free life. The simplest way to do that is to get your basic net worth chart ready.

- Step 1:

Get your documentation ready of every asset that you own and the saleable/ cost of the said asset today. - Step 2:

Jot down all your financial commitments or liabilities that you have including the interest rate against each liability (find out the exact interest rate, don’t assume it). Also jot down the time by when you’ll be able to fulfil the commitment.

(P.C: Pexels.com)

(P.C: Pexels.com)

Once your net-worth chart is ready, you’ll be able to find out the two things upon comparing: if you’re in a debt or not and the present amount of debt if any. This’ll also enable you to analyse how deep are you in debt and how can you prioritise your debt commitments to become debt free in the least amount of time by helping you assess which liabilities can be easily repaid (that actually impacts or will impact your cash flow). Along with this you can also practise matching grant, which denotes that

“Whenever you spend, you should save an equivalent amount of sum for income generation”.

Such a practise would help you learn the art important art of handling finances along with ensuring that you don’t exceed your expenses; i:e; scaling your wealth while diminishing your level of debt. If you’re in a debt, such a practice will work towards income generation for you without creating extra amount of debt; whereas; if you aren’t in a state of debt, then such a practise will act as a shield to your finances. Matching grant is the solution towards long term financial sustainability for each and every one of us.

Therefore, the first rule to overcome debt trap is to find out if you’re in a debt or not and then draft your action plan accordingly. Matching grant is an evergreen practise, one that helps you move up the ladder towards financial freedom while minimising the risk of falling down.

WORK HARD. WORK SMART. LIVE FINANCIAL FREE LIFE.

(P.C: Google Images)

(P.C: Google Images)