Budget and debt are two of the most common words in a financial dictionary. Many know the importance of budgeting and managing debts but very few actually put it to practise. In fact one of the simplest ways of overcoming a debt trap and ensuring long-term sustainability of cash inflow is to practise budgeting.

During our younger days, we generally executed our expenditures carefully so that we had sufficient money for what we wanted to purchase later. Without even knowing about budgeting, we in fact practised it. However somewhere down the line, as we age, we tend to overlook it in our overall financial lifespan which may be one of the major reasons for increasing levels of debt engagement for people.

“It’s interesting to note that throughout our lives, most of us become slaves of money, working everyday day in and day out to earn it but there are those significant few who don’t run behind money but who

make it work back for them.”

(P.C: Google Images)

(P.C: Google Images)

Let’s go step by step in this process. Consider the following questions and answer them from an individual perspective and from your family’s perspective:

- Do you have a comprehensive budget on an annual and monthly basis? Do you work towards that budget?

- Do you jot down all the expenses on an annual, monthly, daily basis?

- Do you budget for even the smallest or the most basic of your expenses incurred on a monthly basis like that on petrol, food items, bills etc?

- Do you face this situation whereby you’re always in need of money time and again for your business or profession or personal expenditures but then you aren’t able to access it or you are unable to see it when you want to?

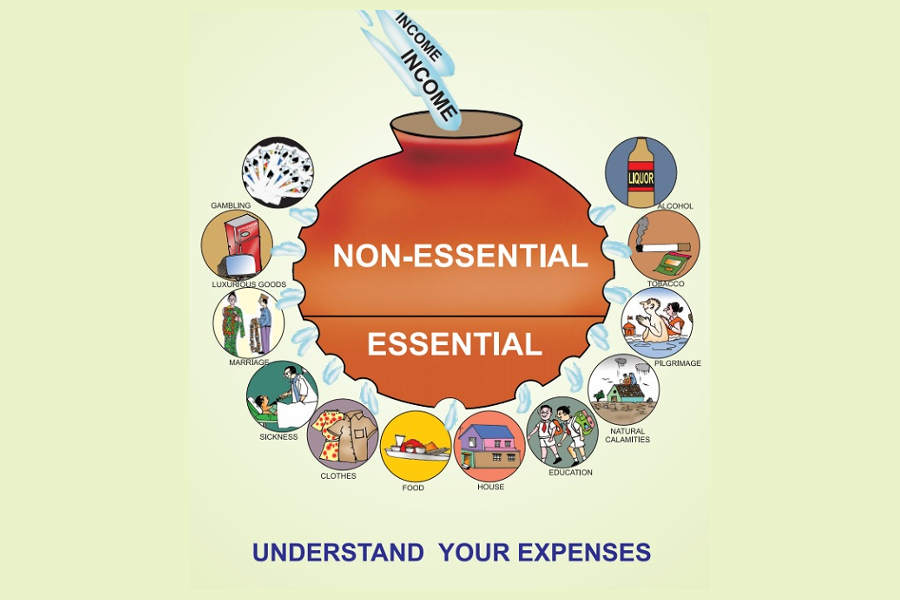

If the answers to any or all of the above questions are a yes, then you’ve reached the first stage: awareness of your current financial status. Now lets’ analyse as to why such situations arise. One of the major reasons is because you’ve involved yourself into unplanned expenditures. For example: you have a holiday budget of Rs.5 lakh only but then you exceed the budget or you undergo impulsive purchasing wherein you buy expensive commodities without even analysing deeply into its requirement, usefulness and price etc. Result being:

| Continued unplanned expenditures -> increase in commitment towards cash outflow -> cash crunch -> lesser access to money as and when needed/desired -> borrowing -> increase in existing debt levels -> increase in risk of falling into debt trap. |

SOLUTION:

“The best way to overcome such a debt trap is to budget it.”

(P.C: Google)

- Budget towards building your emergency corpus fund:

Usually six months emergency corpus fund is good to start with which will be able to take care of any contingencies (eg: job loss, accident etc) that may arise along with also providing a decent ROI. Such a fund would help to responsibly build a financial discipline whereby money can be easily accessed. The question to answer here is that “when you can spend money every month, why can’t you put aside some money and build an emergency fund on a monthly basis!?” - Budget towards building a future fund?

Expenses can be divided into two: certain and uncertain. To counter any uncertain expenses, an emergency corpus fund can be built. However, certain expenses which are generally bound to occur sometime in the future can be planned for right now, in the present and money can be set aside for the same accordingly. For eg: planning for your child’s education, their marriage, your retirement etc. Building a future fund will enable you to focus on areas that matter the most for you, your family and your business/profession. Your expenses and income would also be streamlined in that manner.

(P.C: Google Images)

Money plays an important in your overall happiness and health. Half of the times you don’t even know where the money went, only yesterday you had a huge corpus and now most of it is gone, this is mainly because, you don’t practise budgeting. If you budgeted and noted down exactly what you spent on what, you’d be more aware of your financial health and would also take conscious financial decisions which can ultimately better your financial health.

It’s these simple actions that determine the long term sustainability of anything that you do. Budgeting is that simple action that helps you to stay aligned helps you in ensuring that your cash flows are robustly working back for you. It also takes care of your health as the more your financial process is streamlined, the more your health and happiness is also streamlined. It provides you the base to plan your next action, to work on those areas that need your attention and to also rebalance your finances to better suit your needs.

“TAKE CHARGE OF YOUR FINANCES TODAY AND PRACTISE BUDGETING!”